The Industrial Index displayed the highest annual growth rate in October, gaining 8.5% over the last year.

A Brief Overview

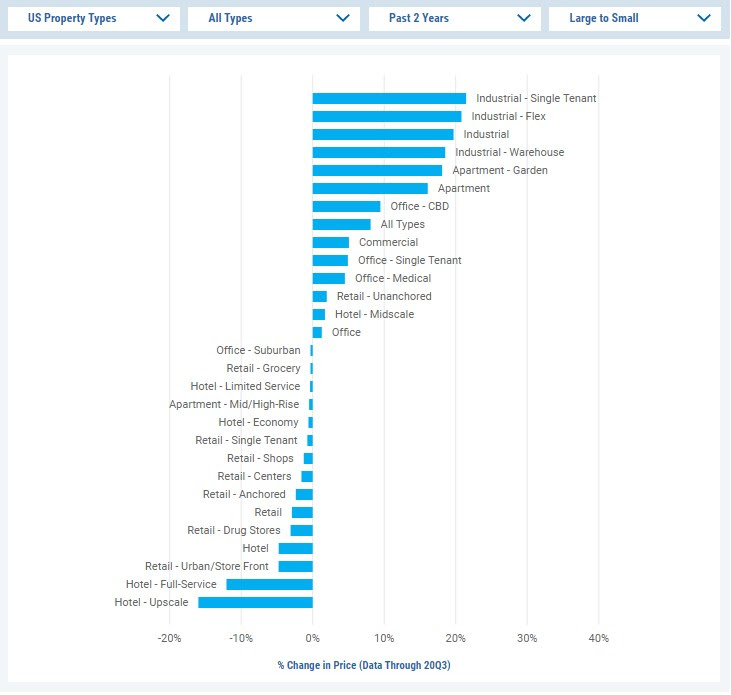

According to Real Capital Analytics (RCA) Capital Trends Report published on Nov. 19, 2020, the national rate of commercial property price growth rose 3.6% in October as the weight of capital invested into the high-flying apartment and industrial sectors boosted gains.

The industrial index maintained the highest annual growth rate in October, gaining 8.5% over the last year.

Apartment prices increased 7.2% from a year ago, closely trailing the Industrial sector’s gain.

Multifamily has been one of the more stable assets during the current economic and health crisis, driven by activity in the secondary and tertiary markets.

Data Shows That Oct. 2020 YOY Price Index Performance Across Major Asset Classes Continued The Last Two Years’ Trend With Industrial and Apartments Sharing The Lead

October retail prices posted another month of declines, down 5.2% over the past year. Returns in the sector are currently at a low not seen since the end of 2010.

The office sector continued to fall at about a 1% annual rate, posting five consecutive months of declining yearly returns. It was primarily the suburban offices that led to that negative growth rate.

Pricing in the Non-Major Metros has held up better than the Major Metros since March.

The flight to safety from the congested, expensive Metro NYC area to the Hudson Valley positively impacted our region’s commercial property prices. Whether Commercial Land or Small Retail or Warehousing; Demand has exceeded Supply in the second half of this year. Amidst all the uncertainty, that is surely a promising sign for our region.